Resources

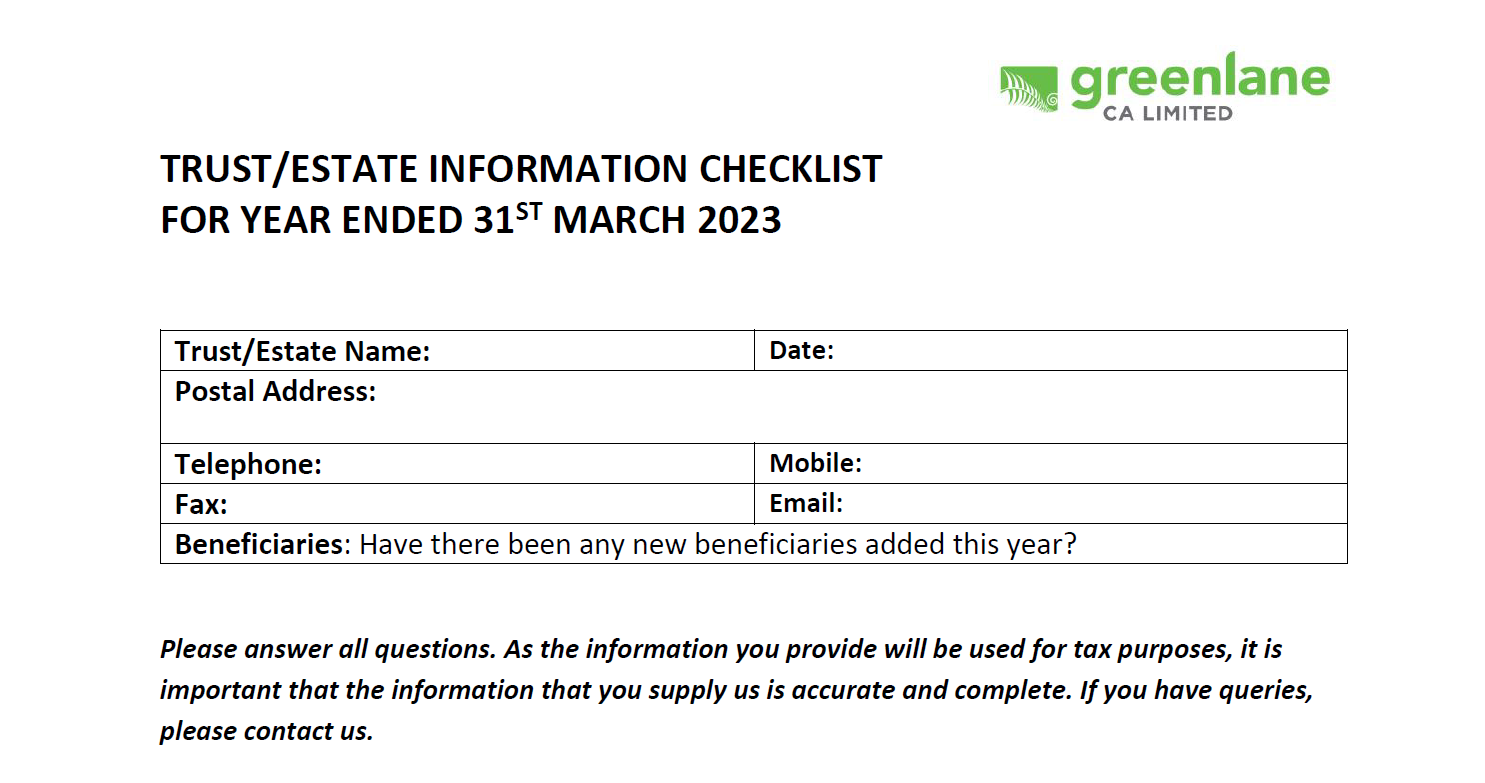

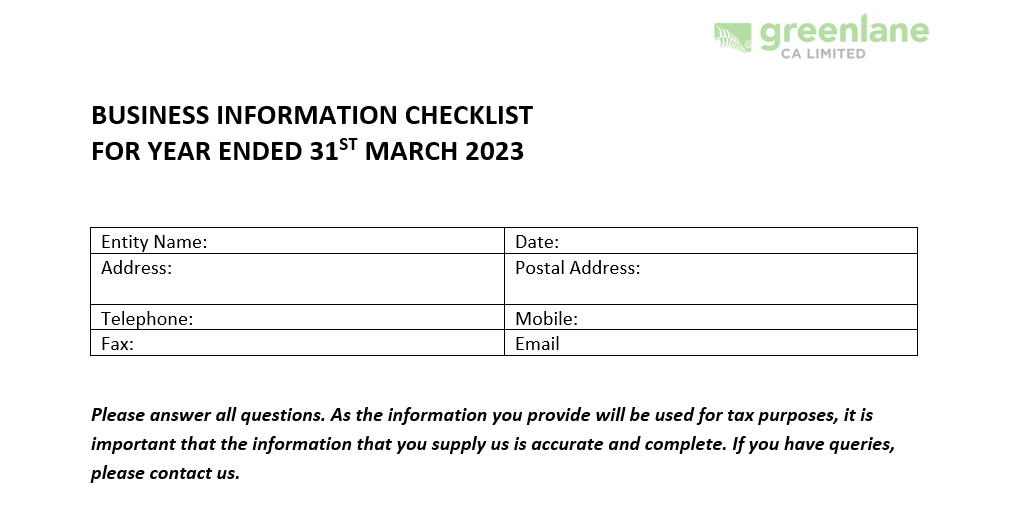

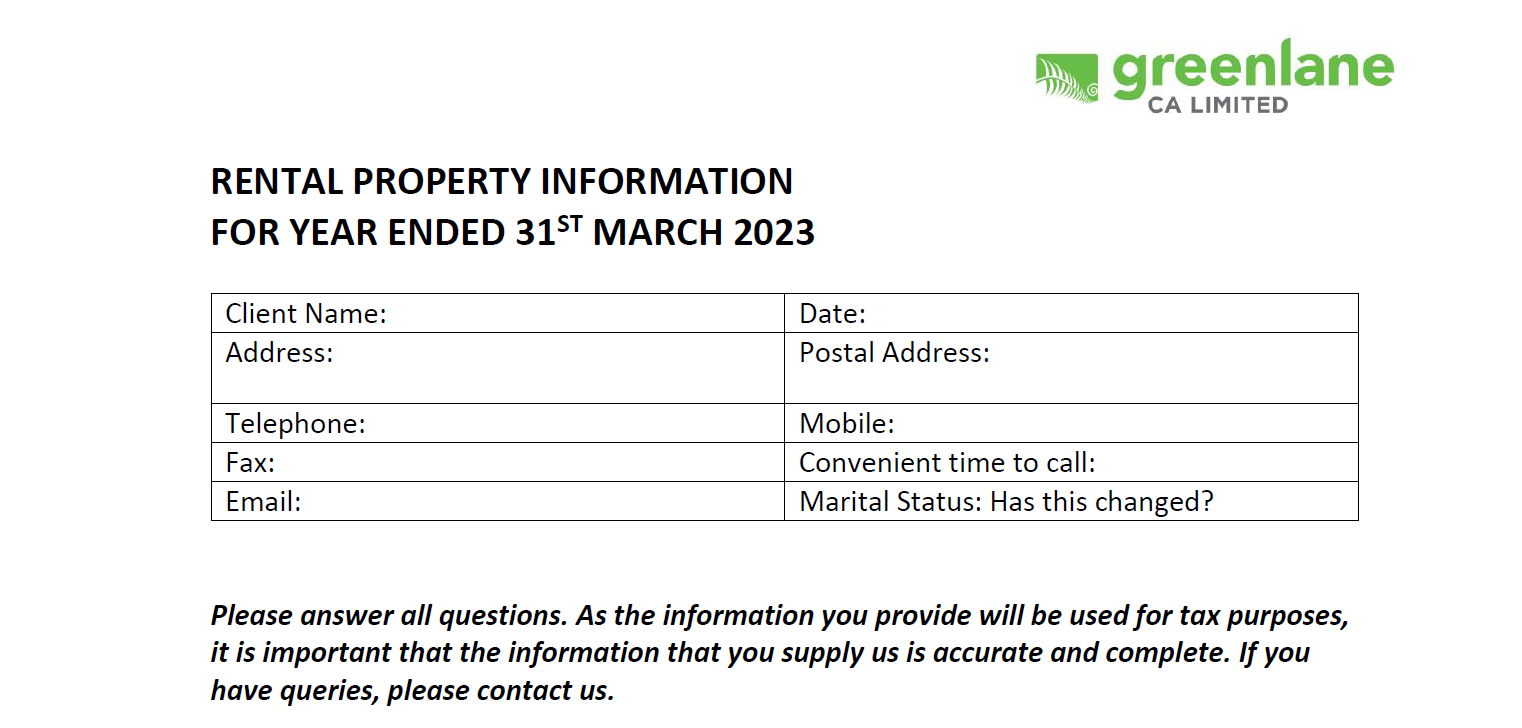

2023 ANNUAL QUESTIONNAIRES

Annual questionnaires are important because they provide us with the essential information, we need to complete your financial accounts and ensure that all your tax obligations are met. This process also allows us to gain a better understanding of your financial affairs and insight into how this could be improved to help your business succeed and grow.

Please take the time to complete the questionnaire(s) that apply to you. You may be required to complete more than one type of questionnaire depending on the entities that are applicable to you. (i.e. Rental investment and Personal)

If you are unsure of the questionnaire that applies to you, or how many questionnaires you are required to complete, please contact us on 09 522 5182 to discuss.